California’s Right to Die Law — A Three Part Series on the End of Life Option Act

By Leslie Blozan, Esq.

Since California’s End of Life Option Act took effect in June of last year, 111 terminally ill people chose to end their lives with medical assistance. Leslie Blozan has us filled-in with what the new End of Life Option Act means in her 3-part series. Parts 1 & 2 you can read below. For Part 3, email mharvey@stonedeanlaw.com to be signed up for Stone | Dean’s At Issue Newsletter.

These articles were originally created for Stone | Dean’s At Issue Newsletter. You can find the originals by clicking here:

Part 1 – https://stonedeanlaw.com/wp-content/uploads/2016/09/SD_NewsletterFall2016_FNL_Web.pdf (Page 5)

Part 2 – https://stonedeanlaw.com/wp-content/uploads/2017/02/SD_NewsletterWinter2017_FNL_Web.pdf (Page 5)

Part 3 – https://stonedeanlaw.com/wp-content/uploads/2017/08/SD_NewsletterSummer2017_FNL_Web2.pdf (Page 4)

Is this Really “The End”? The New California End of Life Option Act and What It Means — Part 1 of 3

On June 9, 2016, the California End of Life Option Act became effective. The new law, based on Oregon’s Death with Dignity Act, allows for competent adults with terminal medical conditions to actively terminate their own life, with a doctor’s assistance.

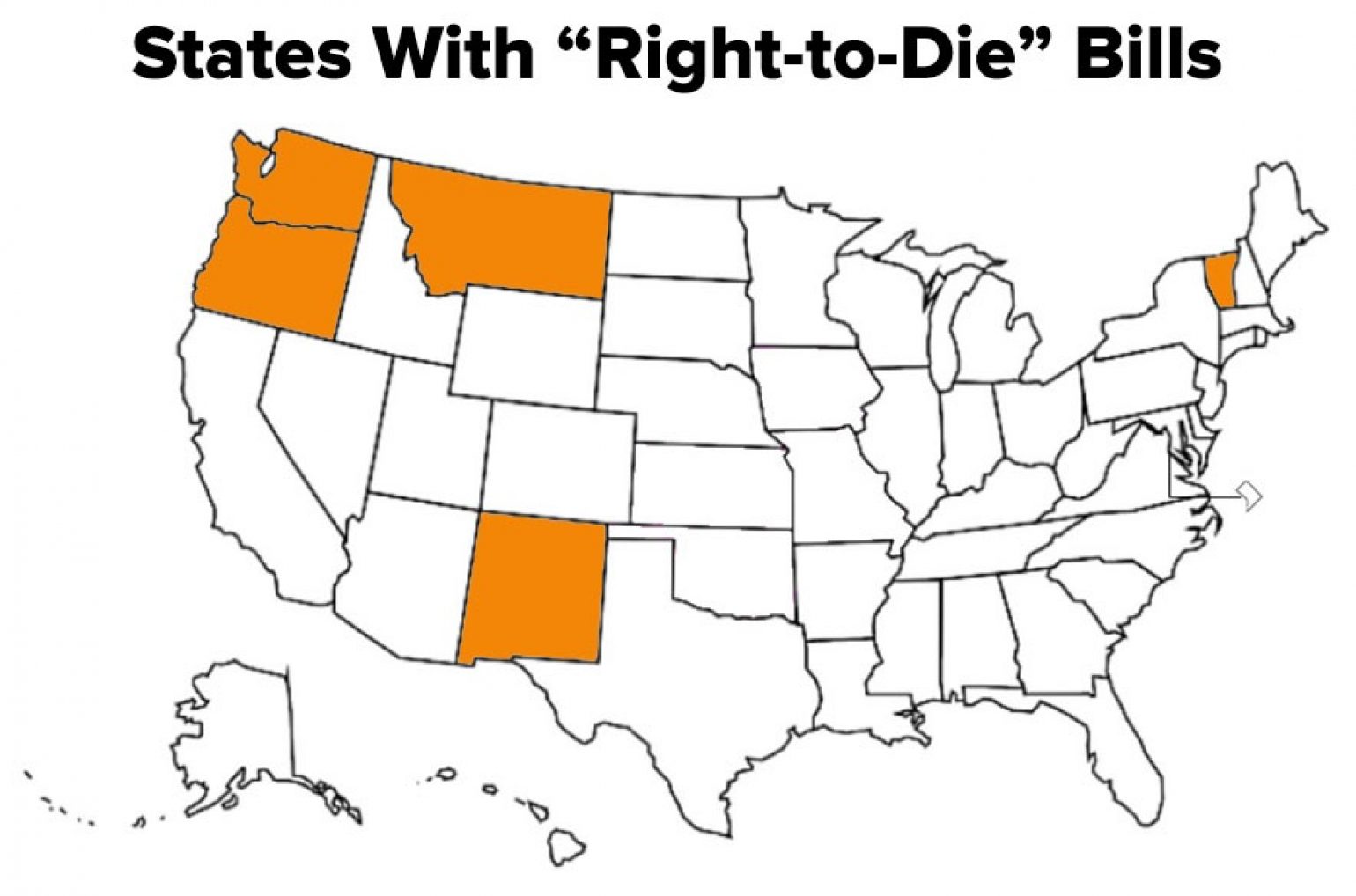

In 2006, the U.S. Supreme Court upheld the 1997 Oregon law that law allows doctors to prescribe controlled substances to terminally ill patients who wish to die. After that ruling, four (4) other states followed with similar legislation and one (1) state allows assisted suicide based on court rulings. Nineteen (19) states are currently considering right to die legislation. Another four (4) states have ambiguous laws that neither prohibit nor support the process.

Under the new law, competent California residents 18 years old or older may request aid-in-dying medication. To qualify for the medication, the patient must be capable of making and communicating healthcare decisions. They must be diagnosed with a terminal disease that will cause death within six (6) months. Once those conditions are met, the patient may consult a doctor willing to prescribe the medication.

A terminal patient must make two (2) verbal requests to their doctor, at least 15 days apart. Then, a written request is required. That request must be signed and witnessed by two (2), competent and qualified adults. Health and Safety Code section 443 contains the required form. The verbal and written requests can only be made by the person with the terminal condition. No conservators, health care agents or persons with power of attorney may make an end-of-life request, even if it is the true, expressed desire of the patient.

After the proper requests are made by a potentially qualified patient, the doctor must confirm the terminal diagnosis and prognosis. The prescribing doctor and one (1) additional doctor must then determine and agree that the patient is capable of making medical decisions. If there is any question, either doctor must require the patient submit to a psychological examination. The doctors must confirm the patient is acting independently, without coercion or undue influence of others.

Once the patient is approved by the doctors, the prescribing doctor presents alternatives other than medication to end the patient’s life. These include palliative care, pain relief and comfort measures. The prescribing doctor then requests, but cannot require, that the patient notify their closest family of the prescription request. The prescribing doctor also must allow the patient the opportunity to withdraw the request for aid-in-dying medication before the prescription is written.

After the medication is prescribed and obtained by the patient, it must be self-administered. No assistance by any third party is allowed, including doctors. Well-meaning friends and family must not participate. Those who do may be criminally prosecuted.

The new law is already facing challenges. Doctors have sued to block implementation. Ethicists disagree whether the law should exist. Some hospitals have opted out of the process. Read Part 2 for a discussion of the controversy and an update on challenges to the law.

Who Will Help Me at “The End”? The New California End of Life Option Act and What it Means Part 2 of 3

Since June, competent, terminally ill Californians have the right to end their lives with the assistance of doctors. In Part I of this article, available in our previous issue online, we described the law and the requirements to exercise these new options.

Now that the right for medically-assisted end-of-life choice exists, the next question becomes: How does it work? Participation in the process is strictly voluntary. A doctor can elect to not participate for any reason or no reason. Many hospitals do not participate due to ethics or legal reasons.

Groups of doctors unsuccessfully sued to block implementation of the law. Individual hospitals have faced internal battles regarding whether or not to participate in the law. The law remains in force, but prospective patients have little guidance in how to proceed.

There is no central clearinghouse of information for those who seek to terminate their lives under the new law. Each patient must conduct the research necessary to find help. The search can seem like an overwhelming process, but there are resources available.

The first challenge for a patient is finding a doctor to guide the process. Family doctors are often reluctant to do so, but may be willing to make a referral. Some doctors are morally and ethically opposed to the new law and will not cooperate on any level. Some doctors do not know specialists who will accept referrals for end-of-life care. Fortunately, there is already a network of medical care providers ready to help.

California Death with Dignity, a project of the Death with Dignity National Center, has a website with information, referrals and resources. The website, www.californiadeathwithdignity.org, posts the text of the California statute and also provides useful legal documents, such as medical care advance directives, medical power of attorney and definitions of commonly used terms, but does not provide doctor referrals.

Compassion & Choices is another organization offering assistance in finding the resources necessary to make and effectuate an end-of-life decision. Their website, at www.compassionandchoices.org, lists useful resources and offers consultations to prospective patients and their families. Those consultations can lead to referrals for medical care.

In San Francisco, Dr. Lonny Shavelson operates Bay Area End of Life Options. Dr. Shavelson is an expert in end-of-life issues and an author on the subject. His organization is dedicated to assisting patients considering ending their lives. He offers free consultations and also assists in coordinating the necessary steps to meet all legal requirements. His website, www.bayareaendoflifeoptions.com, provides guidance through the process, as well as explanations of the law, legal forms and referrals. Out-of-area referrals are available through his organization.

Other resources include local hospices and palliative care providers in local communities. They often have lists of doctors and hospitals for referrals. Estate and elder law attorneys often have contacts for doctor referrals. This office can assist in the referral process, for no charge.

Once the process is initiated, there are legal and financial consequences. Our next article in this series addresses these issues, including health and life insurance considerations for the person seeking to end their life due to illness.

What Happens After I’m Gone? The New California End of Life Option Act and What It Means – Part 3 of 3

For the past year, terminally ill Californians have had the legal right to terminate their lives with medical assistance. The substance of the law was discussed in Part I of this series, and means of pursuing the decision in Part II. This final article in the series addresses medical and life insurance, and what coverages are available.

Death by suicide is typically not covered by insurance. Medical insurance usually will not cover medical costs incurred due to self-inflicted injuries. Life insurance usually excludes coverage for death at the insured’s own hands. Remarkably, however, the California insurance industry sees things somewhat differently.

Under the terms of the California End of Life Option Act, medical insurers and HMOs are not required to cover aid-in-dying costs or expenses. This includes medications, doctor visits, or any other associated fees. Each medical insurance company, plan and HMO will have its own rules. Before considering seeking medical assistance under the Act, the patient should speak with an insurer/HMO representative to see if any coverage exists, even for a portion of the medical care that will be required. The answer may be no, but end-of-life planning requires understanding of the cost burden involved if there is no insurance.

Federally funded medical programs like Medicare and MediCaid do not pay for end of life medical care under the Act; in spite of that, California Medi-Cal does pay for medical services and expenses under the Act.

If the insurer/HMO does not participate in the program directly, they may be able to provide referrals for additional information and assistance. Some insurance organizations and HMOs, however, are opposed to the concept of a person ending their own life. These companies may refuse to provide information or referrals that might otherwise be available. If that happens, the patient can contact advocacy organizations within the state, for more information and referrals.

The California statute clearly states that a person’s choice to end their life, after a diagnosis of a terminal condition, is not suicide. The law views the death as the result of the illness or condition that will lead to death, not as the result of voluntary measures taken by the individual. A death certificate will list the terminal illness or condition as the cause of death; it will not say “suicide.”

The California Insurance Commission underscored the language and intent of the Act, stating in a press release, “Under the new law, if a terminally ill Californian, who meets the criteria in the law, chooses to take the medication to end their own life, the law is clear that is not a suicide, so life insurance policy exclusions for suicide do not apply.”

Although death through means specified in the Act is not legally suicide, life insurance companies may still have a basis to deny a claim. Life insurance policies generally have a 1-3 year period during which the company can contest any claim for benefits. If an insured person dies during this contestability period, the insurer will investigate the death to determine if the policy was fraudulently obtained. An insured must disclose all medical conditions that affect their insurability when they apply for insurance. If any material information is withheld, the company can deny a claim. If an insured commits suicide during the contestability period, a claim will likely be denied. Instead of paying benefits, the company will often return the premiums paid up until the insured’s death.

Even if there is no fraud or misrepresentation in the application, the insurers may be more aggressive in their investigations as to the circumstances surrounding the application and the knowledge of the insured. This remains an open issue, with no case law or statute addressing it yet. In time, suits will be filed and the courts will clarify how the new law works under these circumstances.

The best way to know how any insurer, life or health, will treat a death under the Act is to ask questions and learn in advance. This planning is just one of the many factors to be considered when making a life changing, and life ending decision.

If you or a loved one have questions regarding the End of Life Option Act, or any issue facing the aging population, email the author at LBlozan@StoneDeanLaw.com.

The Elder Law experts at Stone | Dean want to inform seniors and their care-givers of their legal rights and obligations in increasingly litigious times. Find how we can help you by visiting our website StoneDeanLaw.com/practice-areas/elder-law for more information.